On January 25, McKinsey & Company released a report titled "The Net-zero Transition: What It Would Cost, What It Could Bring", which pointed out that in order to Achieving net-zero greenhouse gas emissions will require huge capital expenditures globally, estimated to total $275 trillion. The report examines the impact of the low-carbon transition on various aspects, including industry demand, capital allocation, costs and employment, in 69 countries, which account for 85% of global emissions.

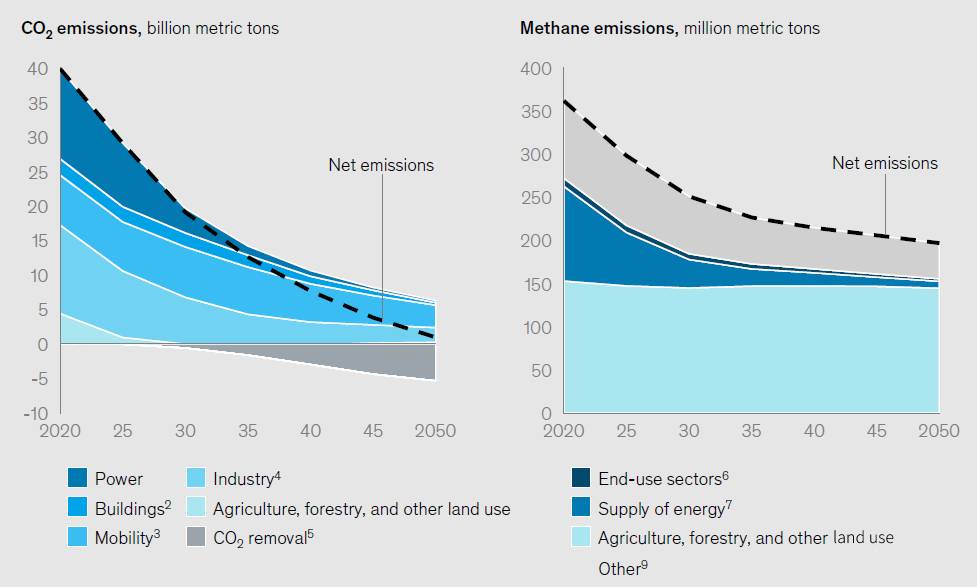

The report uses the Network for Green Financial Systems (NGFS) Net-Zero 2050 Scenario, a hypothetical scenario that reflects the global aspiration to cut emissions by about half by 2030 and achieve net-zero emissions by 2050 (Exhibit E1). Net-zero transition is assessed from two dimensions: industry and geography. First, we examine energy and land-use systems that account for about 85 percent of global emissions: electricity, industry (steel and cement production), transportation (especially road traffic), construction, agriculture and food, forestry, and other land uses. The report also looked at the fossil fuels that power many of these systems. For the geographic dimension, the report provides an in-depth analysis of the impact of 69 countries, which account for approximately 95% of global GDP.

1. Six characteristics of the net zero transition

All industries and countries around the world have the following six characteristics in the net zero transition:

(1) Universal participation. All industries and all countries in the world contribute to greenhouse gas emissions, and achieving net zero emissions requires a general transformation of the global economy. In addition, all systems are highly interdependent, and it is necessary to ensure that relevant mitigation actions are coordinated across systems.

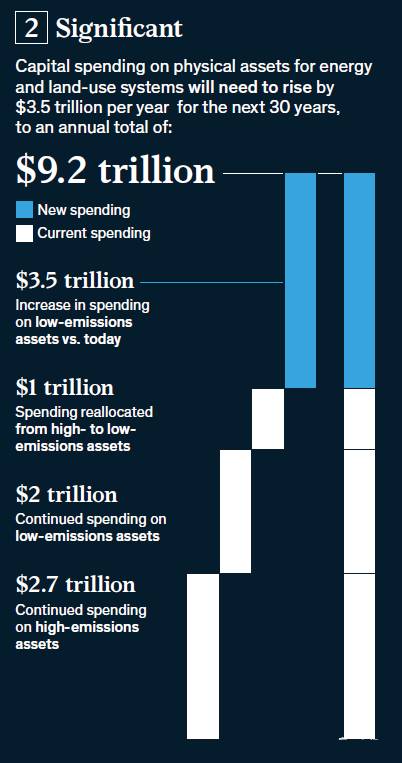

(2) It is of great significance. To achieve a net-zero transition, capital expenditures on physical assets in the global energy and land use system are estimated to reach $275 trillion from 2021 to 2050, or an average of $9.2 trillion per year.

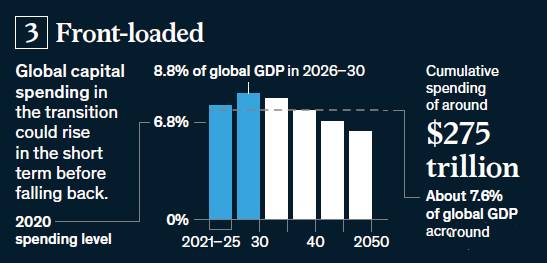

(3) Expenditure focuses on upfront investment. Global spending on transition as a share of GDP will rise from around 6.8% today to 8.8% between 2026 and 2030, and will decline thereafter.

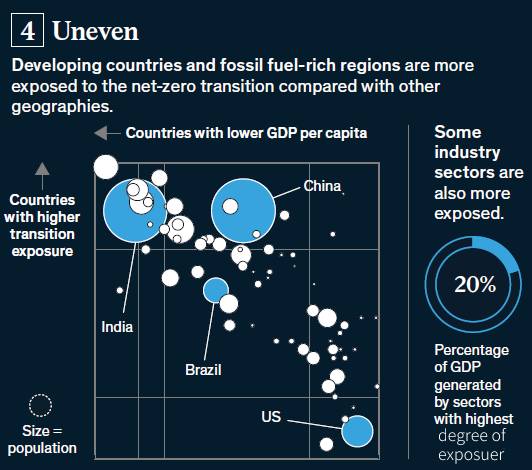

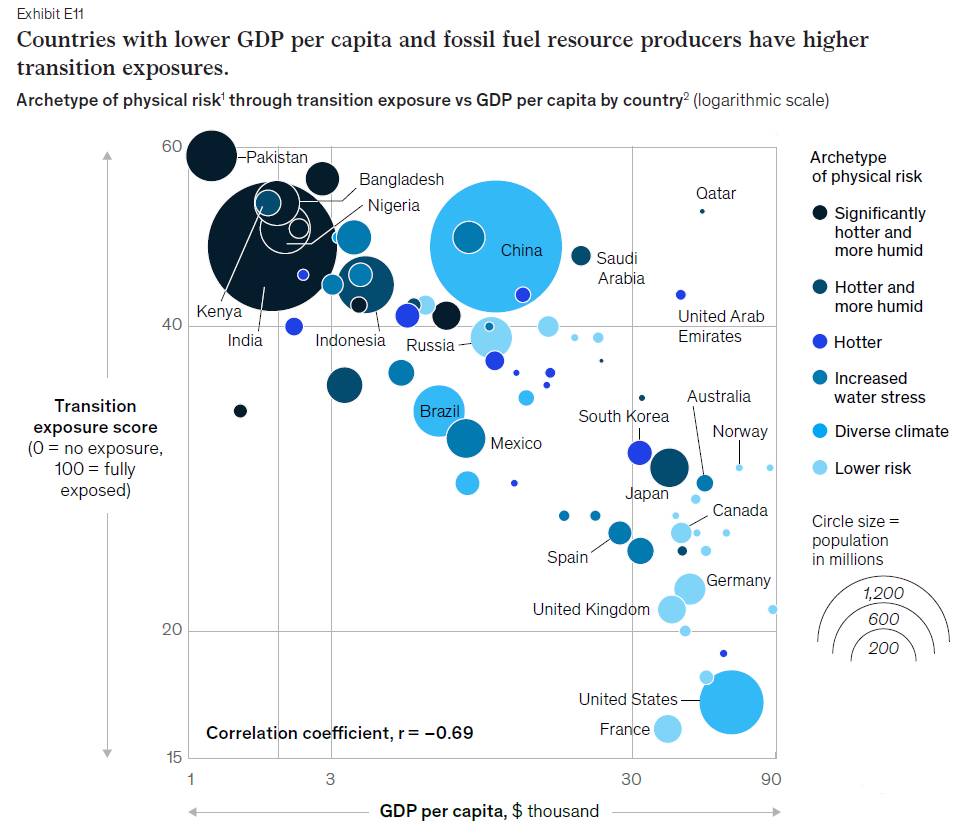

(4) Unbalanced. The risks posed by transformation vary widely across countries, industries, regions, communities and individuals. Industries that account for around 20% of GDP are most directly affected by the transition; low-income countries or countries with economies heavily reliant on industries that produce fossil fuel resources will be more affected; within countries, if the economies of certain communities rely heavily on industries, they are likely to be affected more than other communities; any increase in costs or prices will have the greatest impact on low-income households.

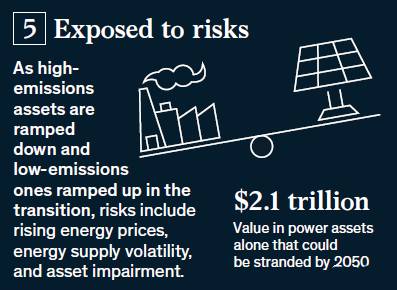

(5) Take risks. All net zero transition scenarios are subject to risks, including: physical climate risks; labor market disruptions; large-scale asset stranding; disorderly energy transitions; energy market and economic volatility; and falling market prices.

(6) Abundant opportunities. As the world transitions to a net zero economy, countries, industries and businesses face enormous opportunities if they can access growing markets, including: preventing the accumulation of physical climate risks; reducing the likelihood of the most catastrophic impacts of climate change ; Decarbonization creates opportunities for growth by increasing efficiency and opening up markets for low-emission products and services.

2. Changes brought about by the net zero transition

(1) Demand. Demand for high-emitting products will shrink, while the use of low-emitting products will create growth opportunities. Demand for combustion engine vehicles will eventually disappear as sales of alternatives, such as electric vehicles, increase from 5% of new vehicle sales in 2020 to almost 100% in 2050. Electricity demand in 2050 will more than double today, while hydrogen and biofuel production will increase more than 10-fold.

(2) Capital allocation. During a net-zero transition, changes in demand will trigger the retirement or transformation of existing physical assets and the acquisition of new physical assets, resulting in changes in spending on physical assets. Asset spending will increase significantly compared to current levels, with global spending on physical assets estimated to reach $275 trillion in 2021-2050. About $1 trillion currently spent on high-emitting assets needs to be reallocated to low-emitting assets.

(3) Cost. As processes are improved and high-emitting assets are replaced or retrofitted, production costs can also change, with consequent impacts on consumption costs. In the steel and cement industries, production costs will rise by around 30% and 45%, respectively, from current levels. Overall costs in other industries are likely to fall. By 2025, the total cost of ownership of electric vehicles is likely to be lower than that of combustion engine vehicles in most regions, and even faster in some regions.

(4) Consumer spending. In the short term, consumers could be at risk of higher prices and higher up-front capital costs, and the extent of the impact will vary based on factors such as consumer spending habits and whether companies will pass on costs.

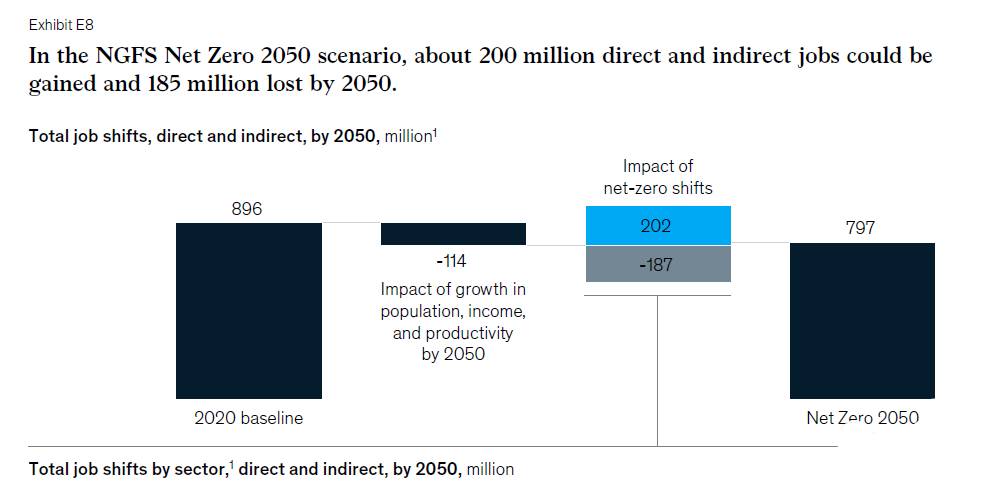

· (5) Employment opportunities. The net zero transition will have a significant impact on the workforce, with around 200 million new jobs and around 185 million lost globally by the mid-21st century. Jobs involved in the extraction and production of fossil fuels will fall by 9 million, while jobs in the electricity sector, which depend on fossil fuels, will fall by 4 million. Renewable power generation, hydrogen and bioenergy jobs will increase by 8 million.

·

· 3. The impact of net zero transition on various industries is uneven

Industries that account for about 20% of global GDP are most affected, including those that directly emit large amounts of greenhouse gases (such as coal and natural gas power generation) and those that sell products that emit greenhouse gases (such as fossil fuels). Another 10% of GDP comes from industries with high-emitting supply chains, such as construction. Other industries, which account for around 70% of GDP, have less immediate risks, but are also affected by the transition due to their reliance on highly exposed industries. The industries affected mainly include:

(1)Fossil fuel industry. By 2050, oil and gas production will be 55% and 70% lower, respectively, than they are today. Coal production for energy use will all but be eliminated. By 2050, employment needs in the fossil fuel extraction and production industries could directly reduce by about 9 million jobs.

(2)Power industry. The transformation of the power sector from 2021 to 2050 will require significant capital expenditures, with approximately $1 trillion for power generation, $820 billion for the grid, and $120 billion for energy storage. By 2050, renewable energy operations and maintenance will add about 6 million jobs and fossil fuel power generation will lose about 4 million jobs. Electricity infrastructure construction and capital expenditures associated with the net-zero transition could generate up to 27 million jobs in the early stages of the transition, and about 16 million direct jobs related to construction and manufacturing activities by 2050, the electricity sector About $2.1 trillion in capital stock could be put on hold.

(3) Transportation industry. Annual spending on vehicles and their charging and refueling infrastructure will reach $3.5 trillion from 2021 to 2050. In addition, some 13 million jobs in the industry directly related to internal combustion engines will disappear, partially offset by 9 million direct jobs related to electric vehicle manufacturing by 2050.

(4) Industry. Steel and cement production can be decarbonized by installing carbon capture and storage (CCS) equipment or switching to zero- or low-emission processes or fuels. By 2050, production costs in both industries could increase by more than 30% from current levels.

(5) Construction industry. From 2020 to 2050, the construction industry will spend an average of $1.7 trillion annually on tangible assets. Decarbonizing buildings could lead to a net gain of around 500,000 jobs by 2050 by insulating buildings.

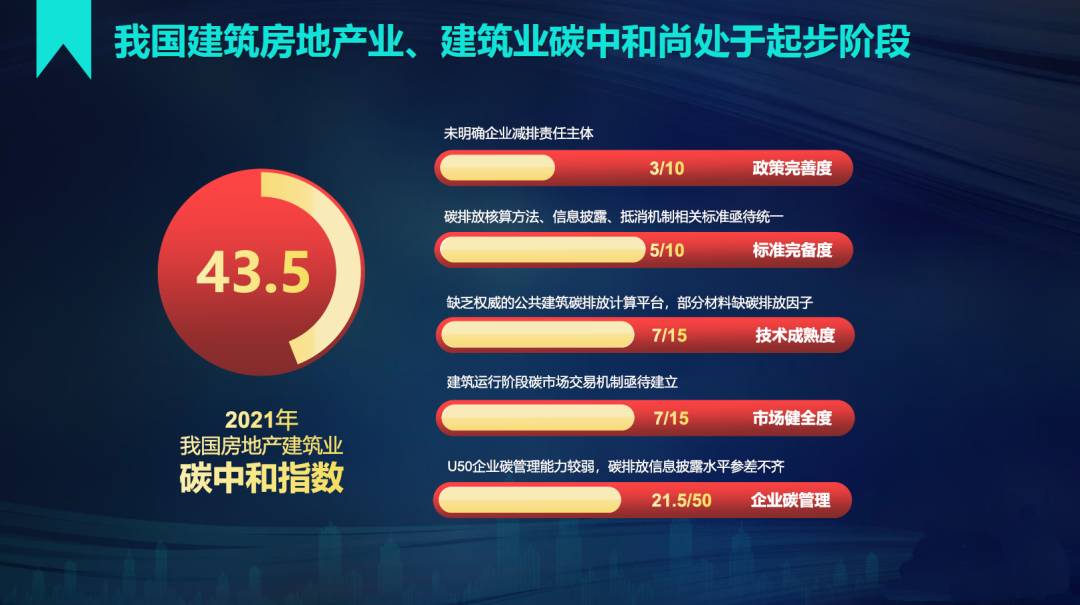

At present, carbon neutrality in my country's real estate and construction industries is still in its infancy; carbon neutrality in the real estate and construction industry requires the joint efforts of the five pillars of policies, standards, technologies, markets and enterprises. According to the "Research Report on Carbon Neutrality Index of Real Estate Construction Industry" released by Friendship Green Think Tank on January 12, if measured by achieving carbon neutrality as 100, the current carbon neutrality index of real estate construction industry is only 43.5.

(6) Agriculture and food industry. By 2050, the net zero transition will result in the loss of some 34 million direct jobs (mainly due to reduced ruminant meat production), while adding 61 million jobs (mainly related to increased production of energy crops and poultry).

(7) Forestry and land use industry. From 2021 to 2050, carbon sequestration will require annual capital expenditures of $40 billion, of which about 75% will be spent over the next 10 years, mainly to acquire and protect land. Voluntary carbon markets and ecosystem services-based industries will generate opportunities for economic gain.

(8) New energy industry (hydrogen and biofuel). Expanding capacity and infrastructure for other low-carbon fuels will require additional spending of about $230 billion per year between 2021 and 2050. By 2050, the hydrogen and biofuel industries will directly create about 2 million jobs.

4. The impact of the net-zero transition varies across countries

Transition risks are higher in countries with lower GDP per capita and in producers of fossil fuel resources

(1) To achieve decarbonization, low-income countries and producers of fossil fuel resources will spend a higher share of GDP on physical assets than other countries, in the case of sub-Saharan Africa, Latin America, India and other Asian countries, They spend 1.5 times or more than advanced economies on supporting economic development and building low-carbon infrastructure.

(2) Relatively high shares of jobs, GDP and capital stock in the fossil fuel sector in developing countries, such as India, Bangladesh, Kenya and Nigeria, for physical capital expenditures required for decarbonisation and low carbon growth Also higher.

(3) The impact may also be uneven within advanced economies. For example, in the 44 counties in the United States, more than 10% of the jobs are involved in the extraction and refining of fossil fuels, or the power generation and automobile manufacturing based on fossil energy, and these jobs will also be greatly affected.

(4) All countries will gain growth prospects by leveraging their natural capital endowments (such as sunlight and forests) as well as technological and human resources.

5. Actions that stakeholders can take

The report calls for more deliberate and decisive action to ensure a more orderly transition to net zero by 2050. Recommendations for various stakeholders are as follows:

(1) Companies may consider incorporating climate considerations into their strategies and decision-making frameworks. Many companies have begun to develop comprehensive plans to achieve net-zero emissions and incorporate these plans into their growth strategies, combining “exploitation” (such as entering new markets, funding R&D, and participating in innovation ecosystems) and “defense” (spinning out to reduce emissions) business or retrofitting high-emitting assets).

(2) Financial institutions can support large-scale capital reallocation. In the short term, they need to consider assessing and disclosing their risks, measuring and committing to reducing emissions from the operations they fund. Over time, they need to translate these commitments into actions to reduce emissions.

(3) Governments and multilateral institutions may consider leveraging existing and new policy, fiscal and regulatory tools to create incentives to support vulnerable stakeholders and facilitate collective action. Public sector organisations play a unique role in managing disproportionate impacts on industries and communities.

(4) Authorized bodies such as standard-setters, industry groups and civil society coalitions are critical to coordinating action across sectors and geographies. Empowering bodies can play a valuable role in setting and enforcing governance standards, convening stakeholders and fostering collaboration, and giving voice to vulnerable workers and communities.

(5) Individuals need to manage their own risks in the net-zero transition and play a strong role as consumers and citizens. Individuals need to understand the impact of the ongoing climate change response and net-zero transition, while adopting new behaviours and consumption patterns. Civic discussion can foster public awareness and engagement, which in turn can lead to decisive and transformative action by government and business leaders.

- 在线实时演示

- Suntrans Plat 能源“云平台”演示

- 产品文件中心

- PWA安装说明